Georgia Bottomley

Global Water Intelligence

Collaborators

Tags

Market TrendsChart of the month: National semiconductor spending plans

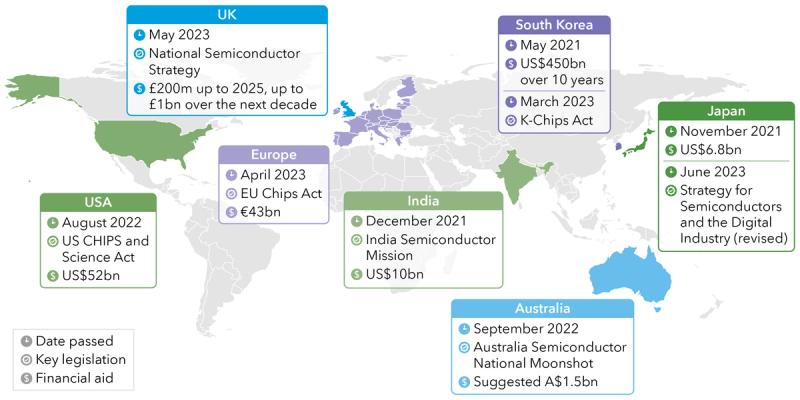

National governments have been releasing strategic documents and passing funding relating to the semiconductor industry in recent years.

Share this insight

The importance of the semiconductor industry to modern life cannot be understated, which is reflected in the growing numbers of national and regional funding strategies published by governments across the globe.

Investment is coming thick and fast over the past few years there has been major investment in the semiconductor industry on a national and supranational level.

National strategies are being imposed to incentivize semiconductor manufacturers to expand their operations to encourage industry growth outside of traditional regional strongholds. The US CHIPS and Science Act has promised $52 billion for the semiconductor industry, and the European Chips Act promises €43 billion investment in the semiconductor industry in the EU. EU member countries have also promised their own funding to entice semiconductor manufacturers. Germany has promised $22 billion in subsidies to Intel, TSMC, and Infineon. Meanwhile, France will provide €2.9 billion of state aid to the joint STMicroelectronics and GlobalFoundries facility in Crolles.

In Asia, where the semiconductor industry already has a firm foothold, investment is also pouring in. For example, Japan and South Korea have announced multi-billion-dollar funding packages for semiconductors. South Korea’s massive $450 billion planned spending over a decade reflects its growing importance in the semiconductor industry – market reports anticipate Korea to lead spending in the mid to long term.

Korea’s investment announcement in 2021 was followed in 2023 by the K-Chips act, which promises 15% tax credits to large firms, increasing to 25% tax credits for small to medium sized companies. In Japan a $6.8 billion (774 billion yen) investment preceded an update to its Strategy for Semiconductors and Digital Industry this year, which provides structure and direction for the use of existing funds such as the Post-5G Fund (200 billion yen) and the Green Innovation Fund (2 trillion yen). Tax incentives also play a substantial role in Taiwan, as local firms are permitted to turn 25% of their R&D expenses into tax credits.

Interest in establishing explicit funding incentives and legislation for the semiconductor industry is growing outside of the traditional regions as countries and governments are vying for the attention of the semiconductor industry. Everybody wants a piece of the chip manufacturing pie.

Share this insight

Related resources

Enabling Time-To-Market for Next Generation Semiconductor Facilities